See what our rewards credit cards offer

ASB Visa Rewards

A low account fee credit card with up to 55 interest free days that earns you rewards on your everyday spending.*

- Earn 1 True Rewards dollar for every $150 you spend.

- Earn 1 Everyday Rewards point for every $2 you spend, plus get 2,000 bonus points every 6 months.**

ASB Visa Business Rewards

A business credit card that lets you have up to four cardholders under one credit limit, letting you earn rewards even faster.*

- Earn 1 True Rewards dollar for every $100 your business spends.

- Earn 1 Everyday Rewards point for every $1 your business spends.

ASB Visa Platinum Rewards

A premium platinum card that earns rewards at our highest rate.*

- Access overseas travel insurance per return trip for you, your spouse and your dependent children travelling with you.

- Earn 1 True Rewards dollar for every $100 you spend.

- Earn 1 Everyday Rewards point for every $1 you spend.

Your rewards, your choice

With an ASB rewards credit card, you can choose between earning True Rewards or Everyday Rewards on your everyday spending. Not sure which rewards option to choose? Check out all the benefits of our two rewards options below and find the right one for you!

True Rewards

Earn True Rewards dollars (TR$) on your everyday purchases and spend instore or online.

- TR$1 = 1 New Zealand dollar.

- Spend TR$ at over 20 partner stores.

- Contribute to your ASB KiwiSaver or donate to a range of charities.

- Alternatively, use your TR$ for travel, merchandise or gift cards at our online store.

- Deals of the week on our True Rewards online store.

Everyday Rewards

Earn Everyday Rewards points on your everyday purchases and earn twice at Woolworths, bp and participating partners.

- Get a $15 voucher with every 2,000 points earned.

- Switch offer: Get 2,000 bonus points when you first make the switch to earn Everyday Rewards and make any qualifying purchase^.

- Exclusive member prices and weekly Boosts personalised to you.

- Redeem your discount voucher at Woolworths or bp.

- Earn twice when you also scan your Everyday Rewards card at participating partners.

How to switch

1. Log in

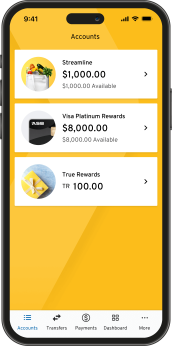

Log in to FastNet Classic or the ASB Mobile Banking app. You may need to download the newest version of the app. Then, select your True Rewards card from the account menu.

2. Select Everyday Rewards

Select the three dots in the top right corner. Then select ‘Switch to Everyday Rewards’, or if you want to switch back to True Rewards from Everyday Rewards, select ‘Switch to True Rewards’.

3. Start getting rewarded

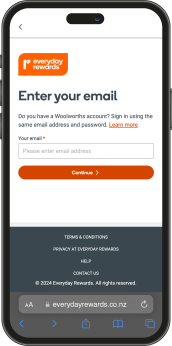

If you selected ‘Switch to Everyday Rewards’, follow the steps to join or sign into Everyday Rewards. If you selected ‘Switch to True Rewards’, you’re good to go.

Which rewards option might work for you?

Below are a few scenarios that showcase the benefits and differences between Everyday Rewards and True Rewards.

Matthew shops at Woolworths and sometimes fuels up at bp service stations. He prefers to earn discount vouchers to help with his food and fuel, so he chooses to earn Everyday Rewards points through his ASB rewards credit card. This allows him to earn points on his everyday transactions and even earn twice when he scans his Everyday Rewards card at Woolworths or bp – which helps him reach his 2,000 points and $15 voucher even faster.

Grace prefers to shop at smaller grocery stores to support local businesses and fills up her car at the closest fuel station when she is running low. She likes to save up her rewards points for big purchases and keeps an eye on the deals of the week through the True Rewards online store. Grace also enjoys visiting the mall in her spare time, which has a number of the True Rewards partner stores.

Don't forget you can switch between our rewards options at any time. Simply log in to FastNet Classic or the ASB Banking Mobile app, select your True Rewards card and follow the prompts.

Credit card features

Take advantage of some of these great features available with ASB credit cards.

Rule your rewards

Score great deals when you use your credit card. Earn True Rewards dollars on your everyday purchases with an ASB rewards credit card.*

Card Control

Manage your ASB Visa cards anywhere, anytime with extra security and control

Bank on the go

Keep track of your transactions and manage your credit card online with FastNet Classic internet banking and the ASB Mobile app

Card Tracker

Track your ASB Visa card subscriptions in one place and see the shops and services where your card details may have been stored.

Apply for an ASB credit card

Need help?

If you're unable to apply online, please call us on 0800 100 600.

We're here to help you

Frequently asked questions

Manage your account

ASB's lending criteria and terms apply. Please refer to the ASB Visa Platinum Travel Insurance Policy for full details. If you are over 75 years of age you are not eligible for cover under the policy. Other exclusions and limitations apply.

ASB's Credit Card Conditions of Use and ASB Rewards Programme Terms apply. Everyday Rewards programme terms and conditions apply.

*You will not earn True Rewards dollars or Everyday Rewards points on cash advances or transactions treated by ASB as quasi cash advances.

Please see ASB Apple Pay terms.

Android and Google Pay are trademarks of Google LLC. For more information please visit the Google Pay support page.

Please refer to ASB Google Pay Terms and Conditions.

Everyday Rewards must be selected as the preferred reward for the relevant ASB rewards credit card.

**For ASB Visa Rewards card customers bonus 2,000 Everyday Rewards points will be credited after remaining on Everyday Rewards for every 6 consecutive statement periods, offer excludes additional card holders.

2000 bonus points offer Terms and conditions:

^Offer is valid from 25 July 2024 until further notice and is limited to one issue of bonus points per True Rewards account. Bonus points will be awarded to eligible account holders at the conclusion of the statement cycle where the qualifying purchase is made, subject to Everyday Rewards remaining the selected reward. Qualifying purchases are those which earn Everyday Rewards points. ASB will provide personally unidentifiable information to Everyday Rewards programme for the purpose of issuing the bonus points.