How do I store my IRD number in FastNet Business?

Last Updated: 26 Jan 2016

With FastNet Business, you can create a list of commonly used IRD / GST numbers, and for each number, add a description.

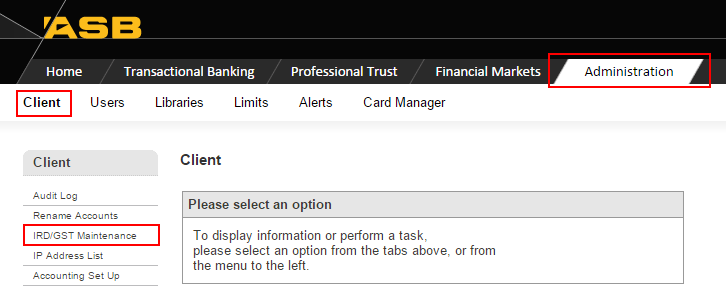

To set up your IRD number(s):

- Click on Administration

- Click on Client

- Click on IRD/GST Maintenance

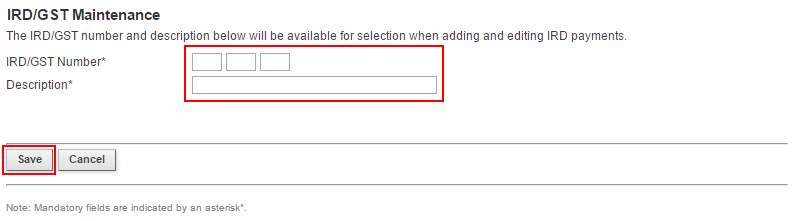

- Click Add

- Type in your IRD / GST Number

- Type in your description

- Save

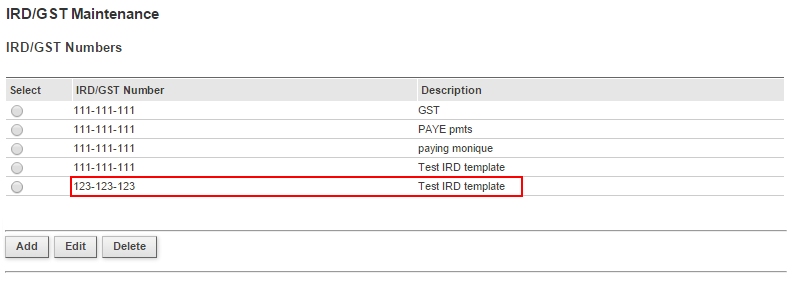

- Once saved, the new IRD / GST number will save on your main IRD/GST page

Did this answer your question?

Related Answers

-

Yes. With FastNet Business, you can set up tax and other payments to pay Inland Revenue, either immediately, or automatically ...

-

Inland Revenue made changes on April 2020 to the tax types you will use when making an IRD payment. If ...

-

There could be a couple of reasons why you cannot see a scheduled IRD Payment in FastNet Classic: If the ...

-

The fields for "Particulars", "Code" and "Reference" allow you to enter information that you want to appear on your statement, ...

-

Yes. FastNet Business allows you to view and modify existing automatic payments and create new ones. You can use this ...

-

If you do not have the FastNet International Module, you can still create IMT’s from a NZ$ account up to ...

-

Before you begin, display the Create Direct Debit Receipt page by: Selecting Transactional Banking on the FastNet Business tab bar ...

-

Even though your payment may have been authorised, it was not ‘sent’ for processing and would have expired at midnight ...

-

With FastNet Business you can make a one-off payment to any New Zealand bank account. Use FastCheque to pay people ...

-

FastNet International is required for non-personal accounts where you are creating an IMT from a Foreign Currency Account and / ...