Compare Funds

Compare the ASB Investment Funds to find the right one for you.

We offer a range of funds to suit different investors. When selecting a fund you should consider your investment timeframe.

- A longer investment timeframe gives you more time to ride out larger ups and downs in your balance. This is good news because accepting those ups and downs comes with a higher potential return - that could mean more money for you to spend later.

- With a shorter timeframe taking less risk becomes more important - while returns are likely to be lower, they will be more stable, giving you less chance of a drop in your balance before you come to make a withdrawal.

- You can withdraw all or part of your investment (subject to minimum balance criteria) earlier than the minimum investment timeframe suggested below, however it is less likely that the performance objectives of the fund will be met. The ASB Investment Funds are subject to investment risk, including possible loss of investment income and principal invested.

View the latest fund updates, market review and recent returns for the ASB Investment Funds.

For more information about how we manage the funds see the Statement of Investment Policy and Objectives.

|

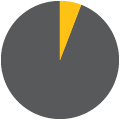

Aggressive Fund

|

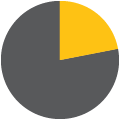

Growth Fund

|

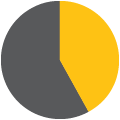

Balanced Fund

|

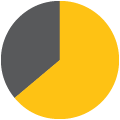

Moderate Fund

|

Conservative Plus Fund

|

Conservative Fund

|

|

|---|---|---|---|---|---|---|

|

Summary of investment objective

|

To provide highest total returns. The number of years with negative returns are expected to be the highest of the multi-sector funds.

|

To provide high total returns. The number of years with negative returns are expected to be higher than the Balanced Fund but lower than the Aggressive Fund.

|

To provide moderate to high total returns. The number of years with negative returns are expected to be higher than the Moderate Fund but lower than the Growth Fund.

|

To provide moderate total returns. The number of years with negative returns are expected to be higher then the Conservative Plus fund but lower than the Balanced Fund.

|

To provide modest to moderate total returns. The number of years with negative returns are generally expected to be higher than the Conservative Fund but lower than the Moderate Fund.

|

To provide modest total returns. The number of years with negative returns are expected to be less than the other funds.

|

|

Investment timeframe

Minimum suggested |

12 years

|

8 years

|

6 years

|

4 years

|

4 years

|

3 years

|

|

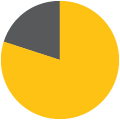

Income assets

|

6%

|

22%

|

42%

|

64%

|

72%

|

80%

|

|

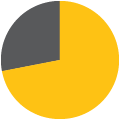

Growth assets

|

94%

|

78%

|

58%

|

36%

|

28%

|

20%

|

|

Annual fund charge

|

1.18%

|

1.09%

|

1.03%

|

0.98%

|

0.93%

|

0.90%

|

Looking for the ASB Investment Funds Positive Impact Fund?

The ASB Investment Funds Positive Impact Fund was wound up on 15 January 2025. For more information about the wind-up of the fund, including some frequently asked questions, check out the Positive Impact Fund page.

ASB Wealth Managers' disclosure statements are available on request and free of charge from your ASB Wealth Manager.

Interests in ASB Investment Funds are issued by ASB Group Investments Limited, a wholly owned subsidiary of ASB Bank Limited (ASB). ASB provides administration and distribution services for ASB Investment Funds. No person guarantees interests in ASB Investment Funds. Interests in ASB Investment Funds are not deposits or other liabilities of ASB. They are subject to investment risk, including possible loss of income and principal invested. Fees may change. For more information see the ASB Investment Fund Product Disclosure Statement available from this website and the register of offers of financial products at www.disclose-register.companiesoffice.govt.nz (search for ASB Investment Funds).